Africa is the last energy frontier, a vast continent whose oil and gas reserves are expected by some analysts to see it emerge as the new global hub. But Africa has a habit of dashing forecasts.

|

In 2000, The Economist dubbed Africa ‘hopeless’. Over the next decade, Africa rebutted that tag: labor productivity rose, inflation dropped and economies boomed. The Economist positively revised its opinion of Africa in 2011. Three years later, a crash in oil prices changed that upbeat narrative with a devastating economic blow to African oil-producing nations. Economies have slowly recovered and Africa’s gross domestic product (GDP) growth is expected to accelerate to 4 per cent in 2019, providing grounds for cautious optimism.

|

What remained unchanged throughout the period is the potential of the African oil and gas sector. The continent possesses 7.5 per cent and 7.1 per cent of global oil and gas reserves, respectively. As international energy prices recover, the continent is again attracting investor interest. Recent oil and gas discoveries coupled with regulatory changes and fast-growing energy demand from expanding local consumer markets offer significant opportunities across the continent, though along with these opportunities come potential pitfalls. It is not only the challenging operating environment, coupled with a lack of transparency, regulatory uncertainty and policy instability, and ongoing infrastructure deficit that hinder investment. In African energy-exporting countries, oil and gas has historically been a primary driver of economic growth. Oil exports can account for more than 90 per cent of revenues and the bulk of fiscal revenues. Yet, countries have been unable to harness these windfalls for sustainable economic development and this is an ongoing constraint to business.

|

Players in the sector must also be mindful of disruptors likely to change the industry. These include rising global demand for liquefied natural gas; the growing prominence of renewables, which could have far-reaching implications; and the potential of the ongoing United States and China trade dispute to disrupt global trade, oil markets and supply chains. Further, digitalization is set to disrupt Africa’s oil and gas sector, where 30 per cent of production stems from legacy fields. The sub-Saharan Africa portfolio of ‘digitally behind’ assets risk becoming obsolete if digitalization is not embraced. This makes the sector ripe for disruption, presenting opportunities for producers and other industry players.

|

There is no universal recipe for winning in the sub-Saharan Africa oil and gas sector. However, soft and hard skills, paired with the right timing, and an understanding of market-specific conditions will bring success. |

How the African industry is evolving : Legacy players

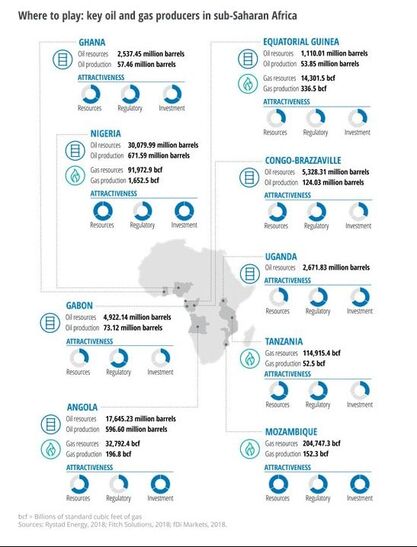

- Nigeria is a mature oil-producing economy with substantial foreign direct investment (FDI), but delays in reforming the sector have deterred further investment. Governance challenges, corruption, as well as economic, security and high cost concerns also hinder investment. The country is still the region’s largest oil and gas producer overall and is expected to be the largest refiner and exporter of petroleum products in Africa by 2022. Improving economic conditions and transport sector growth could see domestic consumption increase by 31 per cent between 2017 and 2023. Investment in gas infrastructure, such as new pipelines, will boost production. Opportunities exist for players with the government intending to privatize ten power stations as part of efforts to guarantee an effective and sustainable power supply in the country.

- Angola is less attractive from a regulatory perspective. It also grapples with corruption, high business costs, low growth and a lack of business diversification. Yet, Angola has the second-largest oil resources and is the second-largest oil producer in sub-Saharan Africa. As a result, it is receiving increasing levels of FDI, boosted by the Angolan government passing several policies in early 2018 encouraging foreign investment. Angola also has the fourth-largest proven natural gas reserves, although the country only produces small amounts commercially. A 2018 presidential decree offers incentives for investment. Consumption is expected to more than double between 2017 and 2023, although the large distances between gas production sites and consumers and a lack of pipeline infrastructure are significant constraints.

- Nigeria is a mature oil-producing economy with substantial foreign direct investment (FDI), but delays in reforming the sector have deterred further investment. Governance challenges, corruption, as well as economic, security and high cost concerns also hinder investment. The country is still the region’s largest oil and gas producer overall and is expected to be the largest refiner and exporter of petroleum products in Africa by 2022. Improving economic conditions and transport sector growth could see domestic consumption increase by 31 per cent between 2017 and 2023. Investment in gas infrastructure, such as new pipelines, will boost production. Opportunities exist for players with the government intending to privatize ten power stations as part of efforts to guarantee an effective and sustainable power supply in the country.

- Angola is less attractive from a regulatory perspective. It also grapples with corruption, high business costs, low growth and a lack of business diversification. Yet, Angola has the second-largest oil resources and is the second-largest oil producer in sub-Saharan Africa. As a result, it is receiving increasing levels of FDI, boosted by the Angolan government passing several policies in early 2018 encouraging foreign investment. Angola also has the fourth-largest proven natural gas reserves, although the country only produces small amounts commercially. A 2018 presidential decree offers incentives for investment. Consumption is expected to more than double between 2017 and 2023, although the large distances between gas production sites and consumers and a lack of pipeline infrastructure are significant constraints.

|

- Congo-Brazzaville joined OPEC in 2018. This, together with a licensing round of 18 blocks (onshore and offshore), could increase investment and reverse declining reserves and production. Production will ramp up in 2019 as projects come online. Refined products consumption has been rising, growing by 28 per cent between 2010 and 2017. This should continue to grow apace with the country’s rapidly increasing population. Refinery capacity is still the main constraint.

- Equatorial Guinea joined OPEC in 2017, but lacks new discoveries and is working maturing oil fields. While oil and gas resources are likely to shrink in the coming decade, the country is still the second-largest producer of natural gas. In May 2018, Equatorial Guinea announced plans to develop a natural gas mega hub linking onshore processing and offshore production facilities. - Crude production has been on the decline in Gabon since 2010. The country re-joined OPEC in 2016 and revamped legislation in the hope of attracting investment, particularly for offshore exploration. These revisions should make licensing and fiscal terms more competitive and flexible. |

New contenders

While established oil and gas countries look to reinvigorate FDI, the spotlight is also shining on Africa’s new contenders. As the region’s newest oil producer, Ghana has seen the highest growth in oil production among its peers. In late 2018, the country launched its first offshore licensing round with six blocks. This contributed to a rise in exploration activity. A long-debated Petroleum Bill, passed in August 2016, is set to improve the broader regulatory environment and remove major barriers to exploration. A favorable ruling in September 2017 on the long-running maritime border dispute with Côte d’Ivoire also brightens the country’s prospects. But refining capacity is constrained, and limited oil pipeline infrastructure may affect consumption.

- Mozambique holds the largest gas resources in the region, so has the largest untapped potential. Domestic and governance challenges aside, the country has seen the largest flow of FDI over the past eight years among its peers. Recent discoveries multiplied proven reserves and will underpin the country’s projected economic recovery. Plans for the coral floating liquefied natural gas development in the Rovuma Basin, as well as the Anadarko Petroleum project in the north are two prominent developments. Given the complexities of these projects, production is not expected until 2022.

- Tanzania has the fastest-growing economy among its oil and gas-producing peers in the region and the second-largest natural gas resources. While production is low, the discovery of new offshore fields has the potential to transform the economy. Its closer location to Asian markets gives Tanzania a geographical edge over peers, although exports of liquefied natural gas based on a planned onshore export facility have been delayed for at least five years.

- Another market to watch is Uganda. Discoveries in 2006 proved the country has the fifth-largest oil resources in the region and new exploration licenses are being awarded. Production is expected to start in 2021 and the construction of a pipeline from Hoima (Uganda) to Tanga (Tanzania) began in 2018.

While established oil and gas countries look to reinvigorate FDI, the spotlight is also shining on Africa’s new contenders. As the region’s newest oil producer, Ghana has seen the highest growth in oil production among its peers. In late 2018, the country launched its first offshore licensing round with six blocks. This contributed to a rise in exploration activity. A long-debated Petroleum Bill, passed in August 2016, is set to improve the broader regulatory environment and remove major barriers to exploration. A favorable ruling in September 2017 on the long-running maritime border dispute with Côte d’Ivoire also brightens the country’s prospects. But refining capacity is constrained, and limited oil pipeline infrastructure may affect consumption.

- Mozambique holds the largest gas resources in the region, so has the largest untapped potential. Domestic and governance challenges aside, the country has seen the largest flow of FDI over the past eight years among its peers. Recent discoveries multiplied proven reserves and will underpin the country’s projected economic recovery. Plans for the coral floating liquefied natural gas development in the Rovuma Basin, as well as the Anadarko Petroleum project in the north are two prominent developments. Given the complexities of these projects, production is not expected until 2022.

- Tanzania has the fastest-growing economy among its oil and gas-producing peers in the region and the second-largest natural gas resources. While production is low, the discovery of new offshore fields has the potential to transform the economy. Its closer location to Asian markets gives Tanzania a geographical edge over peers, although exports of liquefied natural gas based on a planned onshore export facility have been delayed for at least five years.

- Another market to watch is Uganda. Discoveries in 2006 proved the country has the fifth-largest oil resources in the region and new exploration licenses are being awarded. Production is expected to start in 2021 and the construction of a pipeline from Hoima (Uganda) to Tanga (Tanzania) began in 2018.