Ever since the 1973 Arab oil embargo that shocked America, the oil side of the “oil & gas” industry has dominated media coverage and energy policy anxieties—not natural gas. That’s understandable, considering the context of those times.

|

In the two decades leading up to 1973, America had seen oil imports increase eight-fold. And, at that time, transportation was the biggest energy-consuming sector of the economy, using 10 percent more energy than electricity generation, which was the second biggest energy-consuming sector.

But times change. Today, it is the electric sector that is the biggest energy-consumer, using 50 percent more energy than transportation, which is now in second place. The same electrification transformation is underway globally. Meanwhile, not only are US oil imports collapsing, but America today produces 50 percent more natural gas than petroleum (in energy-equivalent terms) and is a major exporter of natural gas—the latter a complete surprise to nearly every forecaster. |

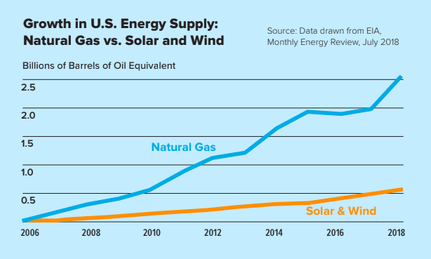

The ascendancy of natural gas, and of the US as a global supplier, has far-reaching implications. Many pundits and “new energy economy” enthusiasts believe that the future is now centered on a hoped-for revolution in supply, coming from wind and solar technologies. But the real revolution—not based on hope—centers on natural gas. Following decades of massive global subsidies and enthusiastic policies, wind and solar power combined now provide less than 2 percent of world energy. In contrast, natural gas now supplies 23 percent of world energy and is on track to displace oil as the number-one source of global energy supply.

|

As with oil, it has been the dramatic impact of the shale revolution in the U. S. that has powered a real energy revolution. American shale technology was responsible for nearly one-third of all the world’s increased production of natural gas over the past decade. The Middle East was slightly ahead, accounting for 40 percent of the new supply. And, over that period, American growth in shale gas added 400 percent more to the US energy supply than did the combined growth of wind and solar, even though these had the advantage of policy preferences, as well as at least $150 billion in cumulative subsidies.

|

The New “Wildcard”

The biggest energy wild card on the near-term horizon is not in the alternative energy domains. Rather, the question is how much and how quickly US gas export capability might grow.

The US position in world energy markets today is similar to its position circa 1918. At that time, the world demand for oil, thanks to automobiles and airplanes, began a steep ascent. The US became the single largest source of new petroleum and then, for a half-century, the dominant supplier of crude oil to the world.

The central energy story today is the growing electrification of the world’s economies, in no small part because of the digitalization of everything. With abundant low-cost natural gas becoming the single largest source of new fuel to power grids, the US has the opportunity to once again become a dominant supplier of fuel for global growth. But can the American gas bounty continue?

The biggest energy wild card on the near-term horizon is not in the alternative energy domains. Rather, the question is how much and how quickly US gas export capability might grow.

The US position in world energy markets today is similar to its position circa 1918. At that time, the world demand for oil, thanks to automobiles and airplanes, began a steep ascent. The US became the single largest source of new petroleum and then, for a half-century, the dominant supplier of crude oil to the world.

The central energy story today is the growing electrification of the world’s economies, in no small part because of the digitalization of everything. With abundant low-cost natural gas becoming the single largest source of new fuel to power grids, the US has the opportunity to once again become a dominant supplier of fuel for global growth. But can the American gas bounty continue?

|

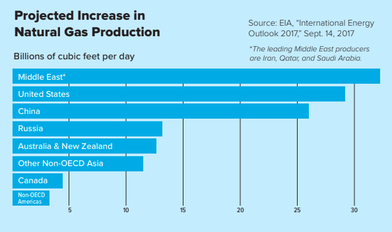

Depending on assumptions, the US Energy Information Agency (EIA) and other organizations forecast that US shale production will increase another 25 to 100 percent over the next two decades. Even in the case of the lower growth, America would become the world’s second-largest source of new natural gas, only slightly behind all Middle East producers combined. While most analysts expect that China will rise to occupy the third position, in terms of net new growth in natural gas production, it will still need imports to meet internal demand (as we will discuss shortly).

|

How It Happened

America’s remarkable transformation in natural gas production did not arise from the discovery of new resources, nor was it the result of government policies or high prices making it more profitable to drill for expensive reserves. Policymakers have been, at best, neutral to natural gas development and, at worst, hostile. And the price of natural gas has remained consistently low over the past decade, at about one-fifth the cost of oil (in energy-equivalent terms).

America’s remarkable transformation in natural gas production did not arise from the discovery of new resources, nor was it the result of government policies or high prices making it more profitable to drill for expensive reserves. Policymakers have been, at best, neutral to natural gas development and, at worst, hostile. And the price of natural gas has remained consistently low over the past decade, at about one-fifth the cost of oil (in energy-equivalent terms).

|

The expectations for future natural gas production are typically based on gauging the pace of improvement in existing techniques and tools that brought about the remarkable increase in output over the past decade. This forecasting task has become easier, given the sheer quantity of data and experience now available from the shale industry. Thus, the conventional wisdom now is that incremental gains in shale technology will lead to continued expansion, even if today’s historically low prices continue.

|

Nearly every forecaster missed the shale revolution.

|

But forecasts of US natural gas production do not take into account technological surprises. That’s why nearly every forecaster missed the shale revolution in the first place.

The shale gas (and oil) industry is entering a new era of productivity, driven by machine learning, artificial intelligence, robotics and sensors linked by low-cost networks to algorithms in the Cloud. These techniques and tools, more common in other industrial sectors, are now penetrating the oil and gas industry, enabling lower costs, faster and more efficient production, and often radically improving productivity.

Digital technologies can, in effect, squeeze more money from rocks. While shale tech, like all technologies, will reach physics limits, the data make it clear that those limits are still a long way off. The underlying geophysics points to a roughly 500 percent gap between what today’s tech can extract from shale and what nature ultimately permits. In a recognition of that potential, EIA’s “high tech” forecast envisions natural gas production increasing more than four times as much in the coming two decades as it did over the previous two decades.

The speed with which more natural gas production can come online will not depend so much on price as on the velocity of technology progress, and the willingness of governments to permit, if not facilitate, the construction of the necessary infrastructures.

The shale gas (and oil) industry is entering a new era of productivity, driven by machine learning, artificial intelligence, robotics and sensors linked by low-cost networks to algorithms in the Cloud. These techniques and tools, more common in other industrial sectors, are now penetrating the oil and gas industry, enabling lower costs, faster and more efficient production, and often radically improving productivity.

Digital technologies can, in effect, squeeze more money from rocks. While shale tech, like all technologies, will reach physics limits, the data make it clear that those limits are still a long way off. The underlying geophysics points to a roughly 500 percent gap between what today’s tech can extract from shale and what nature ultimately permits. In a recognition of that potential, EIA’s “high tech” forecast envisions natural gas production increasing more than four times as much in the coming two decades as it did over the previous two decades.

The speed with which more natural gas production can come online will not depend so much on price as on the velocity of technology progress, and the willingness of governments to permit, if not facilitate, the construction of the necessary infrastructures.

Nowhere To Go But Out

With so much more natural gas output, the key question is: where is the demand? Over the past decade, 80 percent of the increased supply of US natural gas has been used, in roughly equal proportions, to produce electricity in the US, and for exports, even though the latter began just two years ago.

With so much more natural gas output, the key question is: where is the demand? Over the past decade, 80 percent of the increased supply of US natural gas has been used, in roughly equal proportions, to produce electricity in the US, and for exports, even though the latter began just two years ago.

|

EIA forecasts that over the coming two decades, 90 percent of the additional supply of America’s electricity will come from wind/solar and natural gas in almost equal shares. The extent to which even more natural gas is needed for domestic electricity generation will be determined mainly by policies relating to preserving and extending old coal and nuclear plants, and the public appetite to preserve and expand subsidies for wind and solar.

But for gas producers, the central reality is that, in nearly any scenario, domestic electricity growth cannot absorb even 20 percent of the likely increase in domestic gas production. The biggest new demand for US natural gas is overseas. |

Within two decades, the world demand for electricity will increase by an amount equal to adding an entire US power grid. More than 80 percent of the demand will come from emerging economies, none of which have sufficient domestic resources to meet their needs. Meanwhile, Europe will also increase gas imports to power its domestic grids, because natural gas production from the North Sea fields is rapidly declining and expected to drop by about 50 percent over the coming decade. Even the planned expansion of purchases from Russia won’t fill the gap.

The second-biggest driver in increased demand for US natural gas has been in domestic chemical manufacturing. Natural gas is a feedstock used to fabricate chemicals, plastics, fertilizers, pharmaceuticals, biochemical products and various related products. The rising and long-term availability of low-cost natural gas has caused this sector of US manufacturing to boom.

The second-biggest driver in increased demand for US natural gas has been in domestic chemical manufacturing. Natural gas is a feedstock used to fabricate chemicals, plastics, fertilizers, pharmaceuticals, biochemical products and various related products. The rising and long-term availability of low-cost natural gas has caused this sector of US manufacturing to boom.

Since 2010, businesses have poured more than $180 billion into 260 new US chemical manufacturing projects. All are expected to come online by 2020, to generate more than 400,000 jobs, and to consume more gas.

|

No other US manufacturing sector is on track for such rapid expansion. Overall, these planned chemical projects exceed all the existing similar projects in the Middle East. Yet even this torrid growth will not absorb more than 20 percent of the expected rise in US gas production.

|

Overall, these planned chemical

projects exceed all the existing similar projects in the Middle East. |

Globally, transportation accounts for only 2 percent of worldwide natural gas consumption and far less in America. But even a (sensible) 10-fold increase in natural gas use in US vehicles would have a de minimus impact on the surplus of gas production to come.

The bottom line is that in any scenario, the US economy cannot absorb half of the expected increase of 40 to 60 billion cubic feet per day (in energy equivalent of 7 to 10 million barrels of oil per day) in US natural gas production over the coming two decades. But there is more than ample demand coming from global markets.

Upsetting The “Apple Cart”

The liquefied natural gas (LNG) export business requires, of course, equipment to liquefy the gas, costing about $7/BOE (barrels of oil equivalent)—a cost obviously not associated with crude oil. LNG tankers entail a transport cost of about $8/BOE, compared with approximately $1 for crude.

However, the low cost of natural gas production (less than $15 per barrel of oil equivalent) enables LNG to reach world markets for a final cost of about $35/BOE (depending on the distance traveled).

In the energy economy of the 21st century, the new disruptive market dynamic is the increase in demand for natural gas combined with the emergence of America as the single most important supplier. Global natural gas consumption is nearly 200 percent greater today than it was in 1990 and is forecast to double again within the coming two decades. While Asian nations account for the largest share of rising LNG demand, Europe’s need for imports will increase faster than India’s and rival the growth expected for all of Southeast Asia.

In every scenario, roughly 80 percent of the world’s new energy supplies will come from the combination of natural gas and alternative energy, the latter mainly as wind and solar. And, as we’ve noted previously, the prospects (or aspirations) for wind and solar are heavily dependent on public tolerance for sustained subsidies.

As it stands now, the world will soon need far more LNG than existing export capacity can meet. It is entirely feasible for the US to meet half the world’s net new demand for LNG over the coming decades. If that were to happen, it would result in a nearly 10-fold increase over current American LNG exports. Not only would such an expansion yield enormous domestic economic benefits (roughly $200 billion a year added to the US economy), but it would also reshape the geopolitical landscape.

Until recently, two of the biggest suppliers of natural gas into world trade have been Russia (mainly via pipelines) and the Middle East (LNG mainly from Qatar, Iran and Saudi Arabia). Current forecasts for 2040 see Europe increasing its dependence on Russian gas from today’s one-third to 50 percent. And until very recently, options for China and much of Asia have been similar. But now, two new suppliers have upset the old status quo: the completion of enormous offshore LNG projects in Australia and (unexpectedly) the US

The bottom line is that in any scenario, the US economy cannot absorb half of the expected increase of 40 to 60 billion cubic feet per day (in energy equivalent of 7 to 10 million barrels of oil per day) in US natural gas production over the coming two decades. But there is more than ample demand coming from global markets.

Upsetting The “Apple Cart”

The liquefied natural gas (LNG) export business requires, of course, equipment to liquefy the gas, costing about $7/BOE (barrels of oil equivalent)—a cost obviously not associated with crude oil. LNG tankers entail a transport cost of about $8/BOE, compared with approximately $1 for crude.

However, the low cost of natural gas production (less than $15 per barrel of oil equivalent) enables LNG to reach world markets for a final cost of about $35/BOE (depending on the distance traveled).

In the energy economy of the 21st century, the new disruptive market dynamic is the increase in demand for natural gas combined with the emergence of America as the single most important supplier. Global natural gas consumption is nearly 200 percent greater today than it was in 1990 and is forecast to double again within the coming two decades. While Asian nations account for the largest share of rising LNG demand, Europe’s need for imports will increase faster than India’s and rival the growth expected for all of Southeast Asia.

In every scenario, roughly 80 percent of the world’s new energy supplies will come from the combination of natural gas and alternative energy, the latter mainly as wind and solar. And, as we’ve noted previously, the prospects (or aspirations) for wind and solar are heavily dependent on public tolerance for sustained subsidies.

As it stands now, the world will soon need far more LNG than existing export capacity can meet. It is entirely feasible for the US to meet half the world’s net new demand for LNG over the coming decades. If that were to happen, it would result in a nearly 10-fold increase over current American LNG exports. Not only would such an expansion yield enormous domestic economic benefits (roughly $200 billion a year added to the US economy), but it would also reshape the geopolitical landscape.

Until recently, two of the biggest suppliers of natural gas into world trade have been Russia (mainly via pipelines) and the Middle East (LNG mainly from Qatar, Iran and Saudi Arabia). Current forecasts for 2040 see Europe increasing its dependence on Russian gas from today’s one-third to 50 percent. And until very recently, options for China and much of Asia have been similar. But now, two new suppliers have upset the old status quo: the completion of enormous offshore LNG projects in Australia and (unexpectedly) the US

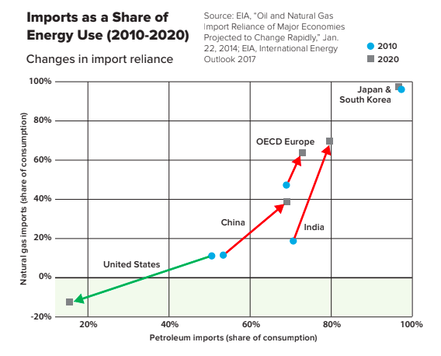

America’s New “Soft Power”

The implications of the new geopolitical era are visible in the trajectories of the energy import dependencies for most nations. Of the five major economic regions of the world that make up 85 percent of global GDP—the US, China, Europe, Japan and India—every region but one is becoming rapidly more dependent on imports of both oil and natural gas. And import dependencies are rising faster for natural gas than for petroleum. One can debate the extent to which Europe, for example, is politically swayed by reliance on Russian gas, but the underlying facts are not debatable. Massive subsidies for wind and solar have not eliminated Europe’s need for more natural gas. Europe already imports half its natural gas, and that share is rising.

The implications of the new geopolitical era are visible in the trajectories of the energy import dependencies for most nations. Of the five major economic regions of the world that make up 85 percent of global GDP—the US, China, Europe, Japan and India—every region but one is becoming rapidly more dependent on imports of both oil and natural gas. And import dependencies are rising faster for natural gas than for petroleum. One can debate the extent to which Europe, for example, is politically swayed by reliance on Russian gas, but the underlying facts are not debatable. Massive subsidies for wind and solar have not eliminated Europe’s need for more natural gas. Europe already imports half its natural gas, and that share is rising.

|

It’s not hard to discern why Russia cares about what the US might do to increase both production and export of natural gas. Almost 40 percent of Russia’s federal budget comes from exporting natural gas and petroleum.

Even before America began exporting, the US oversupply of both natural gas and crude oil (the latter relevant because of its linkage to gas prices), combined with the prospects of imminent exports, triggered a global collapse in gas prices. In order to hold onto market share, Gazprom, Russia’s state-owned natural gas company, sharply reduced its European prices by nearly 30 percent in 2009 and another 10 percent in 2014. |

Germany’s government has taken the position that if “the LNG coming out of the US came to Germany at competitive prices, that would be fine by us.” US shale gas arrives in European markets for less than half the price of five years ago, but even so, pipelines from Russia still deliver it about 20 percent cheaper. Thus for Europe, the question distills to how much it would cost to gain supply diversity (not to mention security) by “buying American.” As a calibration point: if all of Europe’s purchases from Russia on the completed and planned Nord Stream pipelines were replaced with US LNG, that would result in a less than 5 percent increase in Europe’s total annual energy import bill.

The US is on track to become the world’s energy colossus. And provided that policymakers don’t gratuitously hobble one of America’s newest and biggest industries, there are enormous near-term prospects for accelerating both prosperity at home and geopolitical ‘soft’ power around the world.

The US is on track to become the world’s energy colossus. And provided that policymakers don’t gratuitously hobble one of America’s newest and biggest industries, there are enormous near-term prospects for accelerating both prosperity at home and geopolitical ‘soft’ power around the world.

Mark P. Mills is a senior fellow at the Manhattan Institute and a faculty fellow at Northwestern University’s McCormick School of Engineering. In 2016, he was named “Energy Writer of the Year” by the American Energy Society.

This article originally appeared in the 360 Review, Summer/Fall 2019; it is reprinted with permission.

This article originally appeared in the 360 Review, Summer/Fall 2019; it is reprinted with permission.