The growth of battery storage in the power sector has attracted a great deal of attention in the industry and media. Much of that attention focuses on utility-scale batteries and on batteries for commercial and industrial customers. While these larger batteries are critical segments of the energy-storage market, the rapid growth of residential energy storage is outpacing expectations, and these household systems will likely become important assets sooner than many expect. The growth trajectory and potential value of these household systems to customers and the power grid warrants a closer look.

Annual installations of residential energy-storage systems in the US have

jumped from 2.25 megawatt-hours (MWh) in 2014 to 185 MWh in 2018.

jumped from 2.25 megawatt-hours (MWh) in 2014 to 185 MWh in 2018.

During the past four years, annual installations of residential energy-storage systems in the United States have jumped from 2.25 megawatt-hours (MWh) in 2014 to 185 MWh in 2018. Many consumers clearly want the added control, reliability, and resilience that comes from having a battery at home. As a result, many communities may soon have an unexpected resource, a network of home-based batteries that residential customers have already paid for but are not used every day. What would it take to enable residential energy storage to help local utilities make power grids more cost effective, reliable, resilient, and safe? Grids in many regions are under increasing strain. Grid assets are aging. Intermittent sources of renewable energy generate increasing amounts of power, requiring more load balancing. The incidence of severe weather is rising. These trends are worsening bottlenecks and choke points in the energy delivery system, resulting in higher costs and threatening to increase local power outages.

Utilities are taking action to increase grid reliability and resilience. Some utilities already administer so-called demand-response programs that encourage customers to reduce power consumption during peak demand periods. Likewise, utilities are pursuing comprehensive grid-modernization programs to increase capacity and harden the grid system. And some utilities are investing heavily in utility-scale energy-storage solutions, putting big batteries next to power plants and transmission lines and in substations to reduce costs and improve reliability. As more customers invest in “behind the meter” residential energy-storage systems, utilities will gain another potential lever for balancing energy demand and supply. Residential batteries could be linked together and dispatched to deliver grid support services, much as utilities use demand-response programs and ancillary services resources today. Since the batteries are already in place, the marginal cost of dispatching residential energy storage resources could be quite low. This could help utilities avoid more costly remedies such as firing up inefficient peaking plants or building extra grid infrastructure that may only be used infrequently.

Utilities are taking action to increase grid reliability and resilience. Some utilities already administer so-called demand-response programs that encourage customers to reduce power consumption during peak demand periods. Likewise, utilities are pursuing comprehensive grid-modernization programs to increase capacity and harden the grid system. And some utilities are investing heavily in utility-scale energy-storage solutions, putting big batteries next to power plants and transmission lines and in substations to reduce costs and improve reliability. As more customers invest in “behind the meter” residential energy-storage systems, utilities will gain another potential lever for balancing energy demand and supply. Residential batteries could be linked together and dispatched to deliver grid support services, much as utilities use demand-response programs and ancillary services resources today. Since the batteries are already in place, the marginal cost of dispatching residential energy storage resources could be quite low. This could help utilities avoid more costly remedies such as firing up inefficient peaking plants or building extra grid infrastructure that may only be used infrequently.

Integrating residential-storage systems into an efficient, dispatchable network that supports the power grid won’t be easy. But evidence is emerging that it can be done. Some states have launched pilot programs that let utilities pay battery-equipped households for using some of their stored power at times when the system is under strain. To support market development, regulators and utilities will need to assess how and where residential batteries can support the grid (for example, by identifying capacity constraints at the feeder level) and incorporate their assessments into utilities’ resource- and grid-planning approaches. Regulators may also consider fine-tuning rate structures and other compensation mechanisms for batteries and think through how to integrate batteries into system design. Likewise, residential energy-storage network operators will need to make sure customers have bought in to using their batteries to support the grid and demonstrate to the local utility that these behind-the-meter systems are reliable and dispatchable at a moment’s notice when the utility grid network needs the support.

Charting the growth of residential energy storage

Residential energy-storage installations in the United States have increased dramatically—more than 200 percent annually—during the past four years, and rapid growth is expected to continue (Insert). Residential energy-storage installations even exceeded utility-scale storage installations for the first time in 2018, reflecting the high value customers are placing on having their own storage systems. Several factors have contributed to the rapid uptake of residential energy-storage systems:

Charting the growth of residential energy storage

Residential energy-storage installations in the United States have increased dramatically—more than 200 percent annually—during the past four years, and rapid growth is expected to continue (Insert). Residential energy-storage installations even exceeded utility-scale storage installations for the first time in 2018, reflecting the high value customers are placing on having their own storage systems. Several factors have contributed to the rapid uptake of residential energy-storage systems:

- Falling costs. From 2012 to 2017, the per-kilowatt-hour cost of a residential energy storage system decreased by more than 15%/year.

- Increasing disruption risk. Every time a major hurricane or storm hits, battery-installation rates increase sharply. As a result, storm-affected states like Florida and Texas have seen accelerating residential battery adoption. Similarly, homeowners in wildfire-prone areas of California have begun to install home batteries for reliability.

- Utility rate structures. Some utilities set prices based on time of use (TOU), such that power prices vary depending on the time of day. Battery-equipped households can now use energy storage to minimize how much power they consume during periods of peak prices.

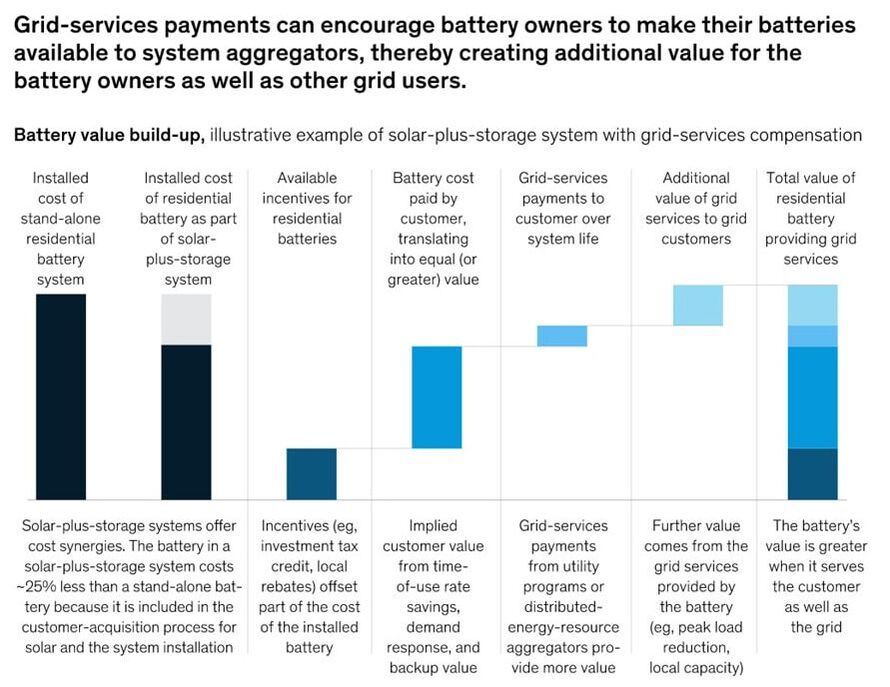

- Solar-plus-storage benefits. Integrated installations of solar and storage equipment cost less and allow even more flexibility in adjusting demand and supply to reflect market rates, potentially reducing the cost of a battery system by more than 25 percent compared with a stand-alone storage pack.

- Purchase incentives. Government incentives for installing residential storage can be compelling. Home solar-plus-storage projects are eligible for the federal investment tax credit, which can bring down the cost of an installed system by 30 percent this year. Local incentives, like California’s Self-Generation Incentive Program, can provide homeowners with $1,600 to $2,500 in savings on typical residential storage systems.

- Grid-services payments. Recently, some local utilities have established programs to pay residential energy-storage owners for feeding power from their batteries to the grid during peak demand periods. In return, customers receive compensation, such as a credit on their utility bill. These “bring your own battery” programs exist in Massachusetts, Rhode Island, and Vermont.

Already, residential energy-storage systems are attractive for more than 20 percent of US households. That market should expand significantly as manufacturers drive down the cost of residential batteries and installers gain the experience and scale to cut installation costs. As a result, we expect continued strong residential energy-storage growth. Annual installations of residential energy-storage capacity could exceed 2,900 MWh by 2023.

Conclusion

The more residential energy-storage resources there are on the grid, the more valuable grid integration may become. So several states are experimenting with grid-integration programs targeted at residential energy storage. Massachusetts and New York are developing “clean peak” policies that promote the use of residential storage, rather than auxiliary fossil-fuel plants, to meet peak demand. And starting in 2020, under an update to the state’s Title 24 standards for building energy efficiency, California is set to require new homes built in the state to have solar power and will encourage builders to add battery storage.

Utilities are mounting experimental efforts of their own. National Grid offers customers a financial incentive to enroll in its bring-your-own-battery program. Liberty Utilities recently launched a pilot program that charges customers a small monthly fee to let Liberty install residential energy-storage systems, creating new backup power sources. ISO New England awarded Sunrun, a home-solar and energy-services company, a contract to deploy a certain number of residential solar-plus-storage systems, adding resources to the capacity market.

Content from How residential energy storage could help support the power grid, March 2019.

McKinsey & Company, www.mckinsey.com. Copyright (c) 2019 McKinsey & Company.

All rights reserved. Reprinted by permission.

Conclusion

The more residential energy-storage resources there are on the grid, the more valuable grid integration may become. So several states are experimenting with grid-integration programs targeted at residential energy storage. Massachusetts and New York are developing “clean peak” policies that promote the use of residential storage, rather than auxiliary fossil-fuel plants, to meet peak demand. And starting in 2020, under an update to the state’s Title 24 standards for building energy efficiency, California is set to require new homes built in the state to have solar power and will encourage builders to add battery storage.

Utilities are mounting experimental efforts of their own. National Grid offers customers a financial incentive to enroll in its bring-your-own-battery program. Liberty Utilities recently launched a pilot program that charges customers a small monthly fee to let Liberty install residential energy-storage systems, creating new backup power sources. ISO New England awarded Sunrun, a home-solar and energy-services company, a contract to deploy a certain number of residential solar-plus-storage systems, adding resources to the capacity market.

Content from How residential energy storage could help support the power grid, March 2019.

McKinsey & Company, www.mckinsey.com. Copyright (c) 2019 McKinsey & Company.

All rights reserved. Reprinted by permission.